Faculty

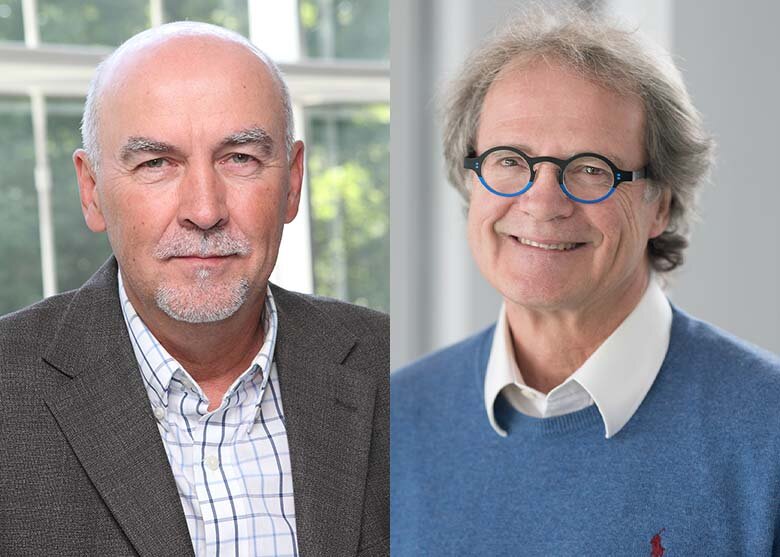

David Ardia honoured at the AFFI conference

June 21, 2022

David Ardia, an Associate Professor at HEC Montréal, and his partners won the Best Asset Pricing Paper award for their article on the performance of hedge funds at the annual conference of the French Finance Association (AFFI), in Saint-Malo, in May.

The paper, Evaluating Hedge Fund Performance when Models are Misspecified, was written by an international team of finance and econometrics experts:

- David Ardia, Associate Professor, Department of Decision Sciences, HEC Montréal, and Group for Research in Decision Analysis (GERAD)

- Laurent Barras, Department of Finance, University of Luxembourg

- Patrick Gagliardini, Institut de finance, Université de la Suisse italienne, and Swiss Finance Institute

- Olivier Scaillet, Institut de recherche en finance, University of Geneva, and Swiss Finance Institute

A brief summary of the paper

The evaluation of hedge fund performance is based on the choice of a factorial model that can capture their different underlying investment strategies. It is challenging to correctly determine this set of factors, and so models are incorrectly specified. To assess the impact of “misspecification” of existing models, the authors developed an approach to formally compare hedge fund models that sharpens performance evaluation by improving the separation between pure alphas and factor exposures.