Faculty

International award for an empirical analysis of trading on the Robinhood platform

July 8, 2025

Three HEC Montréal researchers won the Cascad award for a scientific paper at the annual conference of the French Finance Association (AFFI) that was held from May 26 to 28, 2025, in Dijon, France. This award, presented in partnership with the Cascad platform, celebrates excellence in reproducible research in the field of finance.

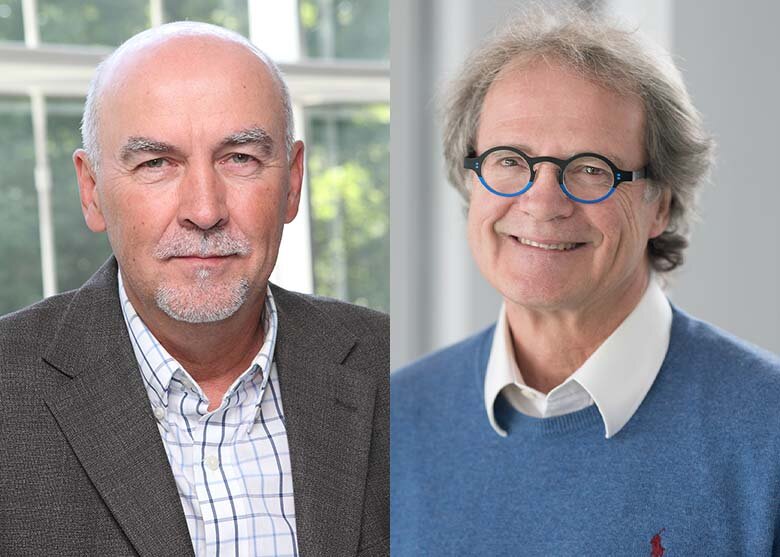

The co-authors of the paper and winners of the award are David Ardia, professor in the Department of Decision Sciences, Tolga Cenesizoglu, professor in the Department of Finance and Clément Aymard, PhD student in finance.

The award-winning paper, entitled Examining high-frequency patterns in Robinhood users’ trading behavior, was published in the International Review of Financial Analysis.

Delving into hourly trading

The study examines high-frequency trading behaviours of investors on the Robinhood platform, analyzing over 7.5 million hourly observations. Unlike traditional analyses at the daily frequency, the authors show that these ultra-connected users react to price movements in a quick, asymmetric and targeted manner.

Three key behaviours were identified:

- A heightened reaction to extreme variations, whether positive or negative.

- A marked contrarian bias, with a propensity to invest in stocks that have experienced sharp declines.

- Very fast reaction speed, concentrated within an hour of a significant decline.

Results amplified overnight and after the pandemic

The researchers also found that these behaviours are more pronounced in response to overnight movements than to fluctuations during the day. A heightened general buying activity among Robinhood investors was also observed following the announcement of the COVID-19 pandemic, with a noticeable acceleration in their response to stock market losses.

Recognition for scientific rigour

The Cascad award highlights the study’s methodological quality and exemplary reproducibility. The Cascad platform, which promotes the transparency and validation of scientific results in finance, praised the HEC Montréal team for its documentation rigour and for making its data and analysis codes available.

David Ardia

Tolga Cenesizoglu