Retirement: Adding to knowledge … and Quebecers’ savings

How much should you put away for retirement? For how long? And in what investments? As the recent stock market downturn and job losses have reminded many, the decisions about retirement savings you make now will be far from inconsequential when you get to retirement age. Well aware that this isn’t always the easiest thing for people to talk about in normal times, let alone in difficult economic times, a multidisciplinary team of researchers is working to equip decision makers and the public with the appropriate tools—research that is truly useful and has a concrete impact on society.

Pierre-Carl Michaud and Philippe d’Astous are trying to find out what should make up your nest egg once you retire. This is more than simply an academic exercise; the two professor-researchers, along with their colleagues at the HEC Montréal Retirement and Savings Institute, are looking into the economic situation of Quebec savers and their financial decisions—sometimes with far-reaching consequences—in anticipation of their old age. Their noble goal: to help people make more profitable choices.

Getting to the bottom of things

Pierre-Carl Michaud, Director of the Institute, explains that the work carried out by the researchers, professors and students who work there focuses on three areas. The first of these has to do with people’s financial behaviour, which falls under the umbrella of behavioural economics. “Since the 1990s, behaviours have changed,” he says. “One out of two Quebecers chooses to start collecting Quebec Pension Plan (QPP) benefits at the earliest possible age—60—while elsewhere in Canada, that percentage is around 30%.” In light of this information, the team is investigating what motivates Quebecers to claim this money earlier, knowing that they will enjoy a higher payout if they wait until they are 65

“It’s important that we avoid taking a paternalistic attitude or judging the motivations behind these choices in our research, since these are irreversible decisions that impact real people,” Michaud continues.

Increasingly advanced calculators

Driven by this sense of compassion, the team is working to develop sophisticated tools to help future retirees make the best possible decisions, which is the researchers’ second focus. For as we all know, there is no universal formula for choosing the optimal time to retire; everything depends on health and life expectancy, accumulated savings and the type of investment products held, the household’s tax situation, etc. All of these variables are integrated into the increasingly sophisticated calculators designed in-house at HEC Montréal.

Informed decision-making

Philippe d’Astous, an Associate Professor in the HEC Montréal Department of Finance, is conducting research into the Retirement and Savings Institute’s third focus: financial literacy. Astous is concentrating his research upstream with the goal of shedding light on how people financially prepare for this important life stage. In one of his recent studies, for example, he looks at how much people know about two popular investment products: the registered retirement savings plan (RRSP) and the tax-free savings account (TFSA). The test given to participants is fairly simple, yet they only answer two of the five questions correctly on average.

The beauty of this study is that it also shows that it is possible to significantly increase these test scores simply by showing participants a short video on the basics of saving for retirement.

“Canadians put $100 billion in their RRSPs and TFSAs every year, with 60% of that amount going to RRSPs and 40% to TFSAs,” says d’Astous. “It’s important to choose the right investment product, since you could stand to lose quite a bit if you don’t consider the tax implications of your choice.”

The preliminary results of the research done at HEC Montréal show one thing: it is difficult to influence savers’ long-term behaviour and get them to change their habits. The researchers have a lot of work ahead of them if they want to improve Quebecers’ financial health and well-being.

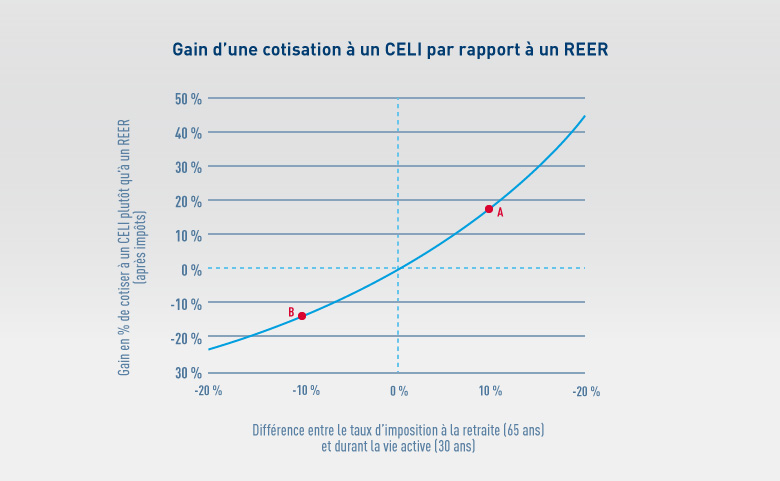

An example of the type of information provided to participants

Graph illustrating the return on a TFSA contribution compared to an RRSP.

This chart shows the percentage return on a $1,000 contribution to a TFSA versus an RRSP contribution, based on the difference in tax rates between the time funds are contributed and when they are withdrawn. When the tax rates at the time of contribution and at the time of withdrawal are equal, i.e., the difference between the two rates is 0, contributing to either product yields the same benefit (% return = 0).

For a single person aged 30 earning $40,000 with a marginal effective tax rate of 35% who plans for a $60,000 income with a 45% marginal effective tax rate when they begin to draw on their retirement fund at age 65, the benefit of contributing to a TFSA rather than an RRSP is 18% after tax (point A on the graph). Conversely, with a $20,000 income and a marginal effective tax rate of 25% at age 65, contributing to a TFSA results in a net loss of 13% (point B on the graph).

This exercise assumes a contribution at age 30, a withdrawal at age 65 and an annual return of 3% above inflation.